Unthinkable but true, almost 70% of insureds kept their coverage with the same car insurance company for a minimum of four years, and nearly the majority have never compared rates with other companies. With the average premium in Arizona being $1,580, drivers could save almost $700 a year by just comparing rate quotes, but they just feel it’s too hard to compare rate quotes.

Unthinkable but true, almost 70% of insureds kept their coverage with the same car insurance company for a minimum of four years, and nearly the majority have never compared rates with other companies. With the average premium in Arizona being $1,580, drivers could save almost $700 a year by just comparing rate quotes, but they just feel it’s too hard to compare rate quotes.

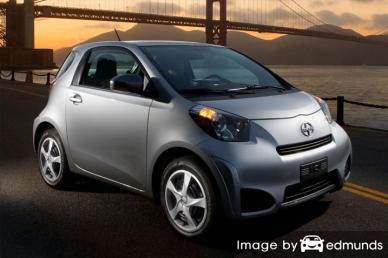

The recommended way to get low-cost Scion iQ insurance in Chandler is to annually compare prices from insurance carriers who provide car insurance in Arizona.

- Get a basic knowledge of car insurance and the changes you can make to prevent rate increases. Many factors that drive up the price such as getting speeding tickets and an imperfect credit score can be amended by making small lifestyle or driving habit changes. Continue reading for tips to prevent rate hikes and get discounts that may be overlooked.

- Get rate quotes from direct carriers, independent agents, and exclusive agents. Direct and exclusive agents can only quote rates from a single company like Progressive or Farmers Insurance, while independent agents can provide price quotes from multiple companies. View insurance agents

- Compare the new rate quotes to your current policy and determine if cheaper iQ coverage is available in Chandler. If you find better rates and switch companies, ensure coverage does not lapse between policies.

- Provide notification to your current agent or company of your intention to cancel your current car insurance policy. Submit the required down payment along with the signed application to the new company. As soon as you receive it, store the certificate verifying proof of insurance in an easily accessible location.

The most important part of shopping around is to compare the same level of coverage on each quote request and and to get quotes from as many companies as possible. This ensures a level playing field and a good representation of prices.

If you currently have insurance, you should be able to find the best rates using the ideas covered in this article. Our objective is to teach you how car insurance companies work and also save some money in the process Nevertheless, Arizona car owners need to have an understanding of how big insurance companies market insurance on the web and use it to your advantage.

Compare quotes for Chandler Scion iQ insurance

When shopping for affordable Scion iQ insurance quotes, there are a couple of ways to compare rate quotes from local Chandler auto insurance companies. The best method to comparison shop consists of shopping online. It’s important to know that comparing more rates from different companies increases your odds of finding a lower rate than you’re paying now. Not every company provides online rate quotes, so you need to compare prices from the smaller companies as well.

The companies in the list below offer quotes in Arizona. To get the best auto insurance in Chandler, it’s highly recommended you visit as many as you can to find the most affordable auto insurance rates.

Choosing vehicle insurance is an important decision

Even though it can be expensive, buying insurance may not be optional for several reasons.

- Just about all states have minimum mandated liability insurance limits which means state laws require a minimum amount of liability insurance coverage in order to license the vehicle. In Arizona these limits are 15/30/10 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $10,000 of property damage coverage.

- If your iQ has a loan, it’s most likely the lender will have a requirement that you have comprehensive coverage to ensure the loan is repaid in case of a total loss. If you do not keep the policy in force, the bank may buy a policy for your Scion at an extremely high rate and force you to reimburse them the higher premium.

- Insurance safeguards both your car and your assets. It will also provide coverage for hospital and medical expenses incurred in an accident. One of the most valuable coverages, liability insurance, also pays expenses related to your legal defense if you are sued as the result of your driving. If damage is caused by hail or an accident, your insurance policy will pay to repair the damage.

The benefits of carrying enough insurance definitely exceed the cost, specifically if you ever have a liability claim. In a recent study of 1,000 drivers, the average customer overpays more than $855 a year so compare quotes from several companies at every renewal to make sure the price is not too high.

Learn How to Lower Your Insurance Costs

Part of the car insurance buying process is learning the different types of things that help determine your premiums. If you have a feel for what positively or negatively impacts your premiums, this helps enable you to make changes that can help you get lower car insurance prices.

The factors shown below are some of the most rate-impacting factors used by your company to calculate premiums.

- Does your vocation cost you more? – Do you have a high-stress occupation? Jobs like lawyers, architects, and medical professionals tend to pay higher rates than average attributed to stressful work requirements and incredibly demanding work hours. Conversely, occupations like actors, engineers and the unemployed pay lower than average rates.

- Driving citations inflate prices – Careful drivers get better rates as compared to those with violations. Only having one ticket may cause rates to rise substantially. Drivers who have multiple violations like reckless driving, hit and run or driving under the influence might be required by their state to submit a SR-22 or proof of financial responsibility with their state in order to legally drive a vehicle.

- Better rates with anti-theft devices – Selecting a car model that has a built-in theft deterrent system can help lower your rates. Theft deterrent systems such as tamper alarm systems, vehicle immobilizer technology and General Motors OnStar help track and prevent auto theft.

- Eliminate unneeded extra coverages – Policies have optional add-on coverages you can purchase if you aren’t careful. Coverages for replacement cost coverage, high-cost glass coverage, and additional equipment coverage may not be needed and are just wasting money. They may seem good when deciding what coverages you need, but if you’ve never needed them in the past eliminate them to save money.

- Single drivers take more risk – Getting married helps lower the price on your policy. Having a significant other is viewed as being more responsible and it’s statistically proven that married drivers get in fewer accidents.

- Fewer miles means better rates – The more you drive your Scion annually the higher the price you pay to insure it. Many insurance companies calculate prices based on their usage. Vehicles used primarily for pleasure use receive better premium rates than vehicles that are driven to work every day. Double check that your car insurance policy reflects the right rating data, because it can save money. An improperly rated iQ can cost quite a bit.

- Which gender costs less? – Statistics show that women are safer drivers than men. Now that doesn’t mean females are better drivers. They both cause fender benders at a similar rate, but guys have accidents that have higher claims. Men also tend to get higher numbers of serious violations like driving under the influence (DUI).

- Low comp and collision deductibles cost more – Physical damage protection, also known as collision and other-than-collision, insures against damage to your Scion. Some examples of claims that would be covered could be a broken windshield, damage caused by hail, and having your car stolen. Deductibles for physical damage are how much you are willing to pay out-of-pocket if you file a covered claim. The higher the amount you have to pay, the less your car insurance will be.

-

Scion iQ insurance loss data – Companies factor in insurance loss information to help calculate premium prices. Vehicles that the statistics show to have a trend towards higher claims will have a higher premium rate.

The data below shows the historical loss data for Scion iQ vehicles. For each policy coverage type, the statistical loss for all vehicles averaged together is a value of 100. Numbers below 100 indicate a favorable loss history, while values over 100 point to more claims or an increased chance of a larger loss.

Car Insurance Loss Data for Scion iQ Models Vehicle Model Collision Property Damage Comp Personal Injury Medical Payment Bodily Injury Scion iQ 77 81 75 BETTERAVERAGEWORSEEmpty fields indicate not enough data collected

Data Source: iihs.org (Insurance Institute for Highway Safety) for 2013-2015 Model Years

Cheaper rates on Scion iQ insurance in Chandler with these discounts

Some providers don’t always list all their discounts very well, so the list below details a few of the more well known as well as some of the hidden discounts that you can inquire about if you buy Chandler auto insurance online.

- Bundled Policy Discount – If you can bundle your auto and homeowners insurance and place coverage with the same company you may save at least 10% off all policies.

- Mature Driver Discount – Older drivers may receive better auto insurance rates.

- Claim Free – Drivers who don’t have accidents can save substantially in comparison to frequent claim filers.

- Defensive Driver Discounts – Taking part in a defensive driver course could save 5% or more and make you a better driver.

- Seat Belt Discounts – Using a seat belt and requiring all passengers to wear their seat belts can save up to 15% on medical payment and PIP coverage.

- Student in College – Kids who attend college more than 100 miles from Chandler and don’t have a car can receive lower rates.

- Drive Less and Save – Keeping the miles down on your Scion may allow you to get lower rates on the low mileage vehicles.

Drivers should understand that most discount credits are not given to the overall cost of the policy. Most only apply to the price of certain insurance coverages like comprehensive or collision. Despite the appearance that you could get a free auto insurance policy, you’re out of luck.

Companies who might offer some of the discounts shown above are:

It’s a good idea to ask each insurance company to apply every possible discount. Discounts may not apply to policyholders in your area. If you would like to view companies that offer some of these discounts in Arizona, click this link.

Local neighborhood insurance agents

Many drivers still like to visit with an insurance agent and often times that is recommended One of the great benefits of getting online price quotes is that you can find cheap car insurance quotes and still choose a local agent.

To find an agent, once you fill out this form (opens in new window), your information is instantly submitted to participating agents in Chandler who will gladly provide quotes for your coverage. You never need to contact any agents due to the fact that quote results will go to you directly. You can most likely find cheaper rates and work with a local agent. If you want to compare prices from one company in particular, don’t hesitate to search and find their rate quote page and give them your coverage information.

Finding the right insurer should include more criteria than just a cheap price. Here are some questions you might want to ask.

- In the event of vehicle damage, can you pick the collision repair facility?

- If they are an independent agency in Chandler, which companies do they recommend?

- Does the company use OEM repair parts?

- How much experience to they have in personal lines coverages?

- Will your rates increase after a single accident?

Compare rates from both independent and exclusive auto insurance agents

When finding a local agent, it’s helpful to know the different types of agents and how they operate. Agents in Chandler are considered either exclusive agents or independent agents.

Exclusive Insurance Agencies

Agents in the exclusive channel can only provide one company’s prices like State Farm, AAA, and Liberty Mutual. These agents are not able to give you multiple price quotes so they have no alternatives for high prices. These agents are usually quite knowledgeable on their products and sales techniques which helps them compete with independent agents. A lot of people purchase coverage from exclusives mainly due to the prominent brand name rather than having the cheapest rates.

Below are Chandler exclusive agents that can give you price quotes.

- Allstate Insurance: Joe Kennedy

2330 N Alma School Rd Ste 126 – Chandler, AZ 85224 – (480) 526-8277 – View Map - Farm Bureau Insurance

912 W Chandler Blvd – Chandler, AZ 85225 – (480) 284-4223 – View Map - Farmers Insurance – Michael Van Oostendorp

4025 W Chandler Blvd #4 – Chandler, AZ 85226 – (480) 899-0898 – View Map

Independent Agencies or Brokers

Agents that elect to be independent can sell policies from many different companies and that gives them the ability to insure through lots of different companies and get the cheapest rates. If prices rise, your policy is moved internally and you don’t have to switch agencies.

If you are comparing car insurance prices, you will want to get rate quotes from a few independent agents to have the best price comparison. They often place coverage with small mutual carriers that many times have cheaper rates.

The following are independent agencies in Chandler willing to provide price quotes.

- Arizona Insurance Guys

3414 W Oakland St – Chandler, AZ 85226 – (480) 331-6408 – View Map - J L Pound Insurance Agency

12139 E Cloud Rd – Chandler, AZ 85249 – (602) 284-2141 – View Map - Parrish Insurance

1256 W Chandler Blvd # G – Chandler, AZ 85224 – (480) 821-1005 – View Map

After getting acceptable answers to all your questions and a good coverage price, you have narrowed it down to a car insurance agent that meets your needs to service your policy.

Chandler auto insurance companies ranked

Selecting a high-quality car insurance provider can be challenging considering how many choices there are in Arizona. The ranking information in the next section may help you decide which insurers you want to consider comparing rate quotes with.

Top 10 Chandler Car Insurance Companies Ranked by Customer Service

- State Farm

- GEICO

- The Hartford

- Mercury Insurance

- Progressive

- The General

- Allstate

- AAA Insurance

- American Family

- Nationwide

Top 10 Chandler Car Insurance Companies Ranked by Claims Service

- State Farm

- Esurance

- AAA Insurance

- GEICO

- Liberty Mutual

- Progressive

- Allstate

- Titan Insurance

- The Hartford

- Mercury Insurance

One last thing to lower rates

You just learned a lot of techniques to save on Scion iQ insurance in Chandler. It’s most important to understand that the more quotes you get, the better chance you’ll have of finding inexpensive Chandler auto insurance quotes. You may even discover the best prices are with a smaller regional carrier.

Some companies may not have rates over the internet and many times these small insurance companies only sell through local independent agencies. Affordable Scion iQ insurance in Chandler can be purchased both online in addition to many Chandler insurance agents, so you should be comparing quotes from both in order to have the best price selection to choose from.

As you restructure your insurance plan, don’t be tempted to reduce needed coverages to save money. In many instances, an accident victim reduced comprehensive coverage or liability limits to discover at claim time they didn’t have enough coverage. The goal is to purchase plenty of coverage at a price you can afford.

Other information

- Warning systems don’t curb driver distraction (Insurance Institute for Highway Safety)

- Who Has the Cheapest Car Insurance Quotes for Low Credit Scores in Chandler? (FAQ)

- What Determines the Price of My Auto Insurance Policy? (Insurance Information Institute)

- Higher speed limits cause more fatalities (Insurance Institute for Highway Safety)

- Side Impact Crash Tests (iihs.org)

- Speed and Speed Limit FAQ (iihs.org)